BLOGS

Opening a merchant account: a step by step guide

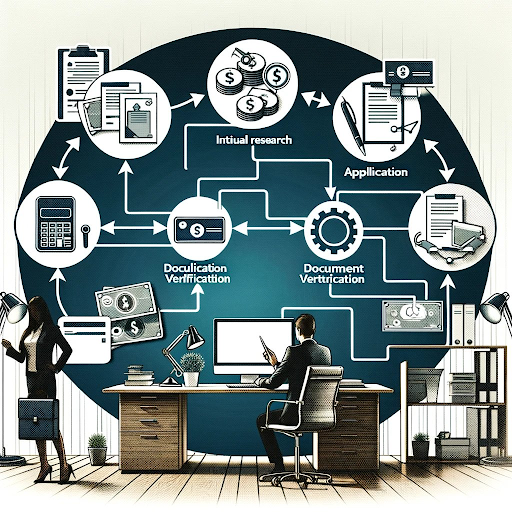

Navigating the process of opening a merchant account can be a critical step for businesses looking to accept credit and debit card payments. Whether you’re a new business owner or looking to switch providers, understanding each step can demystify the process and set you up for a successful partnership with a merchant account provider. This guide will walk you through the essentials, providing a clear roadmap from start to finish.

What You’ll Discover

- Understand the prerequisites and documents needed to apply for a merchant account

- Learn how to select the right merchant account provider based on your business needs

- Get insights into the application process, what to expect, and how to navigate it

Step 1: Understanding the Basics of Merchant Accounts

Before embarking on the journey to open a merchant account, it’s crucial to grasp what a merchant account is, how it functions, and why it’s essential for your business. This foundational knowledge will empower you to make informed decisions throughout the application process.

What is a Merchant Account?

A merchant account is a specialized business account that allows your company to accept and process electronic payment card transactions. Unlike a standard business bank account, which directly holds your business’s funds, a merchant account acts as an intermediary, processing payments made by credit and debit cards, online transactions, and even mobile payments.

How Does It Work?

When a customer makes a card payment, the funds are first processed through the merchant account. The account facilitates the transaction, ensuring the funds are authenticated and approved before being transferred to your business bank account.

Funds typically don’t transfer instantly. There’s a settlement period during which the payment is verified and processed and that’s anywhere between 1-3 business days. Once cleared, the funds move from the merchant account to your business bank account, usually within a few days.

The Importance of a Merchant Account for Your Business

- Accepting Card Payments – In today’s digital age, the ability to accept credit and debit card payments is crucial. A merchant account enables your business to cater to a broader customer base, offering the flexibility and convenience that modern consumers expect.

- Enhancing Cash Flow – By facilitating faster processing of electronic payments, a merchant account helps improve your business’s cash flow, allowing you to access your funds more quickly compared to traditional payment methods like checks.

- Security and Compliance – Merchant accounts adhere to stringent security standards, including PCI DSS compliance, protecting your business and customers from potential fraud and data breaches.

Types of Merchant Accounts

When setting up a merchant account, you’ll have a number of different types of merchant services to select from. Some of the specialist merchant account types include:

Retail Merchant Accounts

Ideal for brick-and-mortar businesses that accept card payments in person. They typically offer lower transaction fees due to the lower risk of fraud in face-to-face transactions.

Online Merchant Accounts

Designed for e-commerce businesses, allowing them to accept payments over the internet. These accounts are equipped with the necessary tools to process online transactions securely.

MOTO Merchant Accounts

This is when a merchant keys in cards for customers using a virtual terminal or sends out an invoice for the customer to pay themselves. This is a Mail Order or Telephone order payment.

High-Risk Merchant Accounts

Some businesses, due to their industry, business model, or financial history, are classified as high-risk. These accounts are tailored to meet the unique needs and challenges of high-risk merchants.

Evaluating Your Business Needs

Before you can open a merchant account, you need to think about your business needs. Look at the following:

- Transaction Volume – Estimate your expected transaction volume, as this can affect the type of merchant account you choose and the fees you’ll incur.

- Average Transaction Value – Understand the average value of the transactions you process, as this can also influence your merchant account fees and terms.

- Industry Specifics – Consider any industry-specific requirements or challenges that might impact your choice of a merchant account provider.

Knowing where you stand and what you need will help you to choose from the merchant account providers available!

Step 2: Preparing Your Application for a Merchant Account

Once you have a solid understanding of merchant accounts and their relevance to your business operations, the next step is to prepare for the application process. This preparation is crucial to ensure a smooth approval process and to secure a merchant account that aligns with your business needs.

Gather Necessary Documentation

Preparation is key to a successful merchant account application. Here’s what you’ll typically need:

Business Documentation – Have your business license, articles of incorporation, and other legal business documents at hand. These validate your business’s legitimacy and structure.

Financial Statements – Prepare your recent financial statements, including balance sheets and income statements. These give providers insight into your business’s financial health.

Tax Information – Your business’s tax ID number or EIN (Employer Identification Number) is essential for tax purposes and identity verification. As a sole proprietor, you can use your social security number as your tax ID, but if you’re an LLC, partnership, or INC, you need to provide a 9-digit Federal Tax ID Number or EIN.

Banking Information – Details about your business bank account, where the processed funds will be deposited, are necessary for the setup.

Projected Sales Volumes – Providers will want to know your estimated monthly sales volumes and average transaction amounts to assess risk and determine your fee structure.

Assess Your Business Model and Needs

Understanding your specific business model and payment processing needs helps in choosing the right merchant account provider.

- Are your transactions mainly in-person, online, or a mix? This affects the type of merchant account you need.

- Certain industries have specialized needs or are considered higher risk, which can influence your choice of provider and account terms.

- Consider how the merchant account will integrate with your current systems, such as point-of-sale systems or e-commerce platforms.

Credit History and Risk Assessment

Your business’s credit history can significantly impact the application process. Providers assess risk based on your credit score, past merchant accounts, and chargeback history.

Credit Score – A good business credit score can lead to more favorable terms, while a lower score might necessitate additional requirements like rolling reserves.

Chargeback History – A history of high chargebacks can classify your business as high-risk, affecting your terms and fees.

Previous Merchant Accounts – Your history with other merchant accounts, including any terminations, will be considered.

Preparing for Underwriting

The underwriting process is where the provider assesses the risk associated with your business. Being prepared can expedite this process. Ensure all the information you provide is accurate and complete to avoid delays. Be clear about the terms being offered, including fees, chargeback policies, and contract length.

Step 3: Choosing the Right Merchant Account Provider

Selecting the right merchant account provider is a crucial decision that can affect your business’s operational efficiency and financial health. With numerous providers in the market, each offering different services and fee structures, it’s essential to conduct thorough research to find the best fit for your business.

- List Potential Providers – Start by listing out potential merchant account providers that cater to your business type and industry. Consider both traditional banks and specialized payment processors.

- Compare Fee Structures – Understand the fee structures offered by each provider. This includes transaction fees, monthly fees, setup fees, and any hidden charges that could affect your overall costs.

- Service Offerings – Evaluate the range of services each provider offers. Does the provider offer integrated payment gateways, point-of-sale systems, mobile payment options, or support for international transactions?

- Contract Terms – Review the contract terms carefully. Look for the length of the contract, any early termination fees, and the specifics of the service agreement.

Evaluate Provider Reputation and Support

Research the provider’s reputation within the industry. Look for reviews, testimonials, and any feedback from current or past customers to gauge the provider’s reliability and service quality.

Consider the level of customer support provided. Efficient, accessible, and helpful customer support can be crucial, especially if you encounter issues or have questions about your account. If they aren’t being helpful enough during the sales process, can you expect them to be helpful at all after the sales process is complete?

Technical and Security Considerations

Assess how easily the merchant account can integrate with your existing business systems. Seamless integration can simplify operations and provide a better experience for both your staff and customers. Ensure that the provider follows stringent security protocols and is compliant with industry standards like PCI DSS. This is vital to protect your business and customer data from potential breaches.

Making an Informed Decision

- Request quotes – Obtain quotes or proposals from the providers you’re considering to compare the actual costs and services side by side.

- Ask questions – Don’t hesitate to ask the provider detailed questions about their services, fees, and any concerns you might have. How they respond can also give you insight into the level of customer service they offer.

- Trial periods or demos for POS solutions – If possible, opt for a provider that offers a trial period or demo of their services. This can help you gauge the compatibility of their solutions with your business needs.

Choosing the right merchant account provider is a strategic decision that requires careful consideration of various factors. By thoroughly researching and evaluating potential providers, you can ensure that you select a partner that not only meets your current business needs but also supports your growth and adapts to your evolving requirements.

Step 4: The Application Process

After selecting the right merchant account provider, the next step is to navigate the application process. This stage is crucial as it involves providing detailed information about your business to secure a merchant account that aligns with your operational needs and financial expectations.

Application Submission

Complete the provider’s application form, which may be available online or provided as a document. Ensure all information is accurate and comprehensive, including business details, financial data, and expected transaction volumes.

Submit all required documentation that supports your application. This typically includes business licenses, financial statements, bank statements, and any other documents requested by the provider.

Review and Verification

Once your application is submitted, it enters the underwriting process. During this phase, the provider assesses the risk associated with offering you a merchant account based on the information and documentation provided.

Expect the provider to conduct credit checks on your business and possibly on the principals of the company. They may also review your business’s financial history, including any previous merchant accounts.

Approval and Setup

If your application is successful, you’ll receive an approval notification. This may come with additional instructions or requirements to finalize the account setup. Follow the provider’s instructions to set up your merchant account. This may involve configuring your payment processing equipment, integrating payment gateways, or setting up software for online transactions.

Testing and Going Live

Before processing live transactions, it’s crucial to test the system to ensure everything is working correctly. Conduct test transactions to verify that payments are processed smoothly and funds are correctly routed.

Based on the testing phase, you may need to make adjustments or resolve any issues identified. Your merchant account provider should offer support and guidance during this phase.

Training and Familiarization

Ensure your staff is trained and familiar with the new payment processing system. They should understand how to handle transactions, address customer questions, and deal with any issues that may arise.

Familiarize yourself with the resources and tools provided by your merchant account provider, including dashboards, reporting tools, and customer support channels.

Step 5: Setting Up Your Merchant Account

After your application has been approved, the next step is setting up your merchant account to start processing payments. This phase is crucial as it involves integrating the merchant account into your business operations, ensuring that you can accept and process payments efficiently.

Integration and Configuration

Payment Gateway Integration

If you’re operating an online business, integrate your merchant account with your website through a payment gateway. This will allow you to accept online payments securely.

POS System or Retail Terminal Setup

For physical retail locations, set up your point-of-sale (POS) system to work with your new merchant account. This may involve configuring hardware like card readers and ensuring the software is compatible with your account.

Mobile Payment Solutions

If applicable, configure mobile payment solutions or apps to accept payments on mobile devices, providing flexibility and convenience for both your business and your customers.

Compliance and Security Measures

Ensure that your setup complies with the Payment Card Industry Data Security Standard (PCI DSS) to protect your customers’ payment information. Implement and maintain robust security measures to safeguard sensitive payment information, including encryption and fraud detection tools.

Employee Training and Familiarization

Educate your staff on how to use the new payment processing systems. Ensure they understand the transaction process, how to handle refunds, and what to do in case of a payment dispute. Provide training on common issues or errors that may arise during payment processing and how to resolve them efficiently.

Testing and Validation

Conduct test transactions to ensure that the payment process is working correctly from start to finish. This should include testing different payment methods and transaction scenarios. Review the results of test transactions to identify any issues or areas for improvement. Make necessary adjustments to ensure that the system is reliable and user-friendly.

Going Live

Once testing is complete and you’re confident in the system’s performance, go live with your merchant account. Start processing customer transactions and monitor the system closely during the initial period.

Keep a close eye on transaction processing, ensuring that everything is running smoothly and efficiently. Watch for any unexpected issues or customer feedback that may indicate a need for adjustments.

Step 6: Ongoing Management of Your Merchant Account

After successfully setting up your merchant account and starting to process transactions, the focus shifts to ongoing management and optimization. This continuous oversight is crucial to ensure the account operates efficiently, remains secure, and adapts to your business’s evolving needs.

Regular Monitoring and Reconciliation

- Regularly review your transactions to ensure they are processed correctly. Look for any discrepancies or unusual activity that could indicate errors or fraudulent activity.

- Consistently reconcile your merchant account transactions with your business bank account and accounting records. This practice helps maintain financial accuracy and simplifies bookkeeping.

Managing Fees and Charges

Keep a close eye on the fees you’re being charged, including transaction fees, monthly fees, and any incidental fees. Ensure they align with your initial agreement. Periodically review your account’s performance and discuss any possible fee adjustments with your provider, especially if your transaction volume has significantly increased or decreased.

Security and Compliance

Regularly review your business practices and payment systems to ensure ongoing compliance with PCI DSS standards. Stay updated with the latest security technologies and best practices to protect your customers’ data and reduce the risk of fraud.

Account Optimization

Make full use of the features offered by your merchant account provider, such as detailed reporting tools, analytics, and fraud prevention services. Use customer feedback and transaction data to optimize the payment process, addressing any pain points or inefficiencies.

Support and Relationship Management

Maintain a good relationship with your merchant account provider. Regular communication can help you stay informed about new features, compliance updates, or potential service improvements. Ensure you know how to access customer support quickly and efficiently. Responsive support can be crucial in resolving transaction issues or addressing account concerns.

Stay Informed

- Industry trends – Keep abreast of trends and changes in payment processing, such as new payment methods, regulatory changes, or emerging security threats.

- Adapt and innovate – Be prepared to adapt your payment processing strategies to meet changing market conditions, customer preferences, or business goals.

Effective ongoing management of your merchant account is essential for maintaining financial stability, ensuring customer satisfaction, and supporting your business’s growth!

Merchant Accounts through Vector Payments

Vector Payments provides specialized merchant accounts for low, medium, and high-risk businesses, designed to address the unique challenges and complexities these sectors face. Our solutions offer flexibility, scalability, and top-notch security, ensuring efficient and secure payment processing. With our expert support, cutting-edge fraud prevention, and competitive rates, we streamline your financial operations, allowing you to focus on growing your business. Our quick integration process gets you up and running fast, making Vector Payments the ideal partner for ALL merchants seeking reliable and supportive payment processing services. Contact us today to learn more.

FAQs

How can I reduce the fees associated with my merchant account?

Regularly review your account’s fee structure and negotiate with your provider. Utilizing more efficient transaction methods and reducing chargeback rates can also help lower fees.

What should I do if I notice unauthorized transactions on my account?

Immediately report any suspicious activity to your merchant account provider. Implement additional security measures and review your transaction processing protocols to prevent future issues.

How often should I review my merchant account’s performance?

Conduct a thorough review at least quarterly. Regular monitoring helps you stay on possible charge ratio increases, transaction patterns, and any emerging issues that need attention.