BLOGS

Decoding ACH vs eCheck: Uncovering the Best Payment Method for You

Deciding between ACH and eCheck for your payment processing?

This comparison cuts through the jargon to focus on what matters to you: processing times, costs, and relevant applications. ACH vs eCheck: ACH is a staple for recurring payments while eCheck shines with its quick processing for one-time transactions. In the following sections, we’ll explore their respective benefits and help you pinpoint which method aligns with your financial needs.

Key Takeaways

- ACH payments, facilitated by the Automated Clearing House network, can be categorized into ACH debit and credit transactions, taking one to three business days to process and widely used for various forms like direct deposits and recurring bills.

- eChecks offer a digital alternative to paper checks, providing faster processing times of 24 to 48 hours, enhanced security, and lower costs, making them suitable for one-time online payments and businesses with large transaction volumes.

- Both ACH and eCheck payments require authorization and data protection but have differences in processing times and fees, with ACH generally being more cost-effective for high-volume transactions, whereas merchants often utilize eChecks for their speed and lower fees compared to credit cards.

Unveiling the Basics of ACH Payments

When it comes to electronic transactions, ACH payments stand as a popular choice. The term Automated Clearing House (ACH) refers to a payment processing network primarily used in the US for bank-to-bank electronic transactions. This network facilitates the transfer of money between bank accounts in the US, thanks to a federal EFT system run by the National Automated Clearing House Association (Nacha).

ACH transactions are versatile and include various forms such as an ACH transaction for:

- Direct deposits

- Utility payments

- Payroll

- Interest payments

Processed in batches usually once a day, ACH payments typically take one to three business days to process, offering a streamlined alternative to traditional payment methods.

The Two Faces of ACH: Debit and Credit

ACH payments are commonly categorized into two main types: ACH debit and ACH credit transactions. Each type serves different purposes and has distinct characteristics. ACH debits are commonly used for bill and utility payments, ensuring they are made consistently without the need for manual authorization each time. This automatic system not only saves time but also reduces the risk of missed payments.

On the other hand, ACH credits are typically used for direct deposits, including paychecks and tax refunds, directly transferring funds into recipients’ bank accounts. By bypassing the need for physical checks, ACH credits offer a more efficient method for individuals and businesses to receive payments.

How ACH Transactions Navigate the Financial Network

The ACH network is like a vast web, connecting thousands of banks and financial institutions for payments. It facilitates the movement of funds between different bank accounts across the network, ensuring a smooth and efficient flow of money.

A critical player in this process is the payment processor. They utilize bank routing numbers and bank account information to enable electronic transfers, serving as the bridge between the sender’s and recipient’s bank accounts. This intricate yet efficient system ensures that ACH transactions are conducted securely and swiftly.

Exploring eCheck Payments: The Digital Reinvention of Traditional Checks

While ACH payments offer a reliable solution for recurring payments and direct deposits, eChecks have emerged as a game-changer in the realm of one-time payments. Essentially, an eCheck is an electronic version of a traditional paper check. An electronic check serves the same purpose as a paper check. However, being in electronic format allows for a quicker and more streamlined processing.

Some benefits of using eChecks include:

- Faster processing times

- Reduced costs compared to paper checks

- Increased security and fraud protection

- Convenient and easy to use

Overall, eChecks provide a convenient and efficient way to make one-time online payments, making them a popular choice for many businesses and individuals.

The eCheck transaction process, also known as electronic funds transfer, involves the steps to process echeck payments:

- Customer authorizing the payment from their customer’s bank account

- Providing banking details

- Processing these details electronically from one account to the other through the ACH network

What sets eChecks apart is their speed. They typically process within 24 to 48 hours, making them significantly faster than traditional paper checks.

From Authorization to Completion: The eCheck Journey

The journey of an eCheck transaction begins with the customer’s authorization. This can be initiated via online forms, phone conversations, or signed order forms. To complete eCheck transactions, key information such as account number, federal tax ID number, business name, and address must be provided.

The eCheck processing involves three primary stages: the authorization request, payment setup with all required details, and submission of the transaction through the ACH network. To ensure the secure and effective processing of eChecks, specific software is required before submission into the ACH system. This robust system ensures that eChecks are not just convenient, but also secure.

Why eChecks Can Be a Game-Changer for Merchants

Beyond convenience and speed, eChecks offer several advantages for merchants. For one, they come with lower processing fees compared to fees charged for credit card payments. This cost-effectiveness can significantly impact a merchant’s bottom line.

For businesses that operate on a subscription-based model, eChecks offer several benefits:

- Ensure timely and automatic deductions from the customer’s bank account, reducing operational hassle

- Faster processing times make funds available more quickly for merchants

- Time and cost savings contribute to overall business efficiency

By embracing eChecks, merchants can enjoy these advantages.

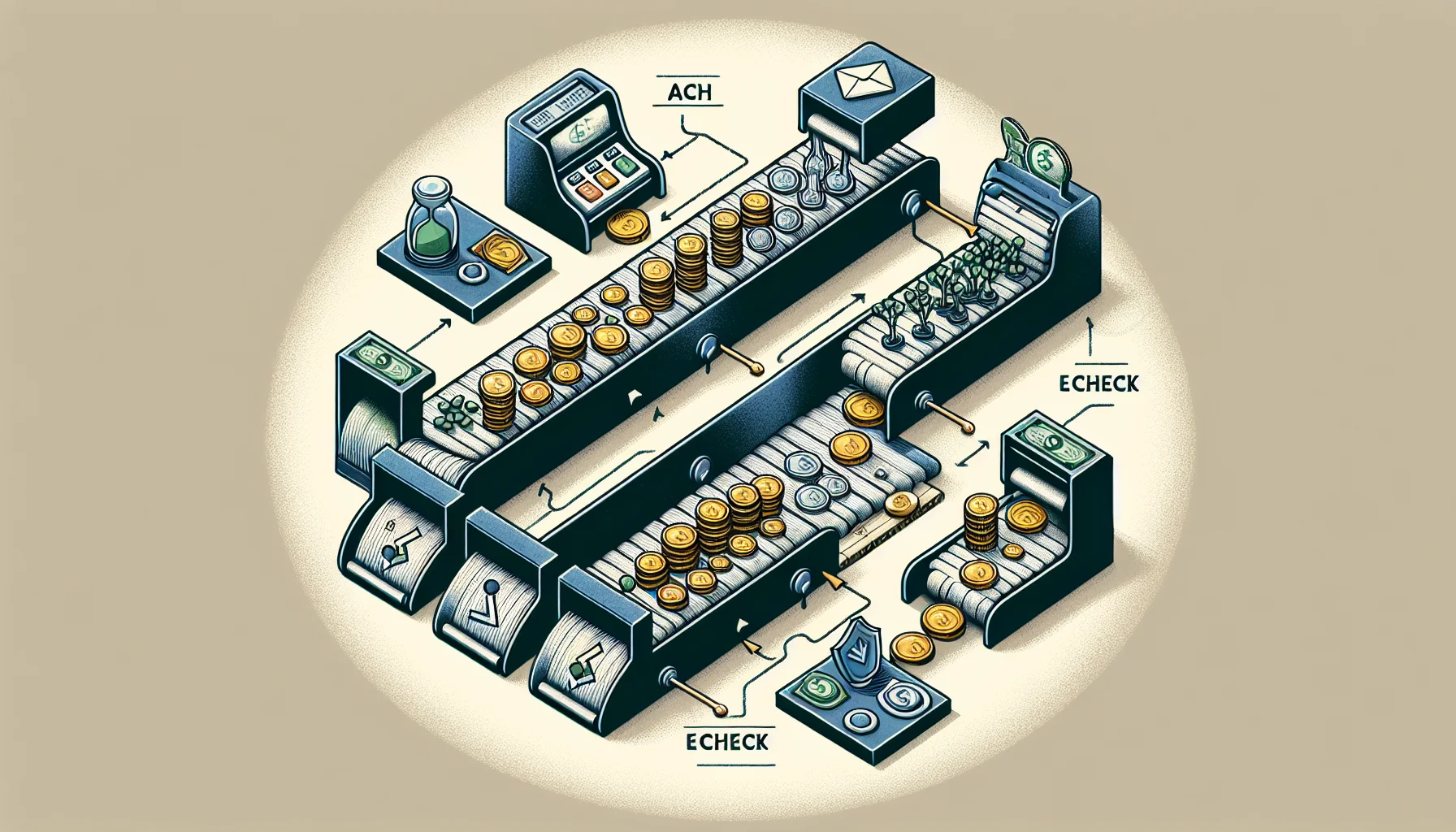

A Side-by-Side Comparison: ACH vs eCheck

With a clear understanding of both ACH and eCheck payments, it’s time to compare them side by side. Both payment methods share key similarities. They typically take 1-2 business days for funds to clear, with eChecks often processing faster within 24 to 48 hours due to skipping the manual deposit process. They also provide cost-effective transaction processing, often involving low or no fees, which is beneficial for both consumers and businesses.

Moreover, both ACH and eCheck payments require customer authorization and utilize robust data protection and processing security measures. Yet, despite these similarities, there are notable differences in terms of fees and usage, which we will delve into in the following subsections.

Processing Fees and Time Frames: eCheck vs ACH

When it comes to processing fees and timeframes, ACH payments generally have the upper hand. Around 80% of ACH payments are settled within one banking day, while eCheck transactions take three to five business days to complete after the ACH process begins. However, some banks offer accelerated clearing alternatives for eChecks that lead to shorter processing times.

As for the fees, ACH payments usually incur lower processing fees compared to eChecks. eChecks can result in additional costs for verification and may incur fees if returned, but are generally cheaper than credit card transaction fees. These factors make ACH a more cost-effective option for businesses, particularly those with high volumes of transactions.

Recurring or One-Time? Choosing the Right Payment Type for Your Needs

Choosing between ACH and eCheck often boils down to the nature of the transaction. ACH processing is ideal for merchants with subscription-based business models as it enables the collection of recurring payments efficiently. On the other hand, eChecks are conducive to handling recurring payments, especially for sizable transactions like mortgage or car loan payments.

However, ACH is frequently preferred for recurring expenses such as payroll due to its efficiency in handling such transactions. Accepting both ACH and eCheck payments is beneficial as they offer customers more choice and result in lower processing fees for merchants. In the end, the best choice depends on the specific needs and circumstances of your business.

Navigating Payment Gateways and Processors: How They Fit into ACH and eCheck Transactions

The role of payment gateways and processors in ACH and eCheck transactions cannot be overlooked. These intermediaries play an essential role by converting checks into ACH transactions and initiating the process for both eCheck and ACH payments. This ensures that transactions are conducted smoothly and efficiently.

Utilizing an integrated payment process provider that manages both eCheck and ACH payments is considered a best practice for secure payment processing. Providers adhering to NACHA Operating Rules & Guidelines and employing compliance specialists and risk analysts enhance security and comprehension of ACH and eCheck payment processing.

Moreover, companies should have services that adapt to handle different payment environments such as face-to-face or online, by converting checks to the appropriate ACH or Check 21 transactions.

Overcoming Payment Challenges with Vector Payments

In the complex world of payments, businesses often grapple with various challenges, from confusing rate structures and hidden fees to underhanded sales practices. This is where Vector Payments steps in. With over 30 years of experience offering payment processing solutions, Vector Payments has significant expertise in merchant services for both low and high-risk industries.

Vector Payments offers the following benefits to merchants:

- Clear rate structures and no hidden fees

- Dedicated 24/7 support

- Compliant hardware terminals at no cost

- Recommendations for payment-agnostic POS solutions

These features aim to simplify the payments experience and enhance and streamline merchant operations through the integration of a merchant’s payment processor.

Tailored Solutions for Every Business

Vector Payments recognizes that every business is unique and requires a customized approach to payment processing. The company provides a variety of payment processing tools and services, customized to support different business models effectively.

Businesses receive support from Vector Payments in navigating the bank approval process, streamlining what can often be a complex and time-consuming task. Transparent rates and fees are a cornerstone of Vector Payments’ service, coupled with in-depth education for merchants on the nuances of payment processing.

Personalized assistance from Vector Payments ensures that businesses are guided at each step, from selecting the optimal payment method to its full-scale implementation.

Transparent Rates and No Hidden Fees

Affordability and transparency are at the forefront of Vector Payments’ offerings. The company champions the cause of clarity in payment processing rates and fees to suit the specific needs of businesses. No hidden fees are imposed on merchants, irrespective of the risk profile of the industry they operate in.

Vector Payments actively addresses prevalent payment processing problems like confusing rate structures and underhanded sales practices to foster trust with customers. This commitment to transparency and customer-centric approach sets Vector Payments apart in the crowded landscape of payment solutions.

Best Practices for Secure and Efficient Payment Processing

Ensuring secure and efficient payment processing requires adherence to certain best practices. Here are some recommendations:

- Implement a system to detect fraudulent transactions.

- Establish authentication measures for customer identity.

- Verify check features alongside customer identity for eCheck transactions, especially for checks accepted by phone or the web.

Following these practices can enhance the security of ACH and eCheck payments.

To avoid potential fraud with paper checks, businesses should:

- Inspect the check’s appearance

- Confirm the account holder’s signature

- Corroborate the ID of the customer presenting the check

- Reproduce authorizations in the same form as presented to customers and retain these records for a minimum of two years

- Set up an ACH payment system via a payment gateway for their checking account to facilitate support for both ACH and eCheck transactions, leading to a simple and efficient process for requesting customer authorization.

Summary

In the digital era, the way we manage payments is evolving at a rapid pace. ACH payments and eChecks are at the forefront of this transformation, offering a secure, efficient, and cost-effective alternative to traditional payment methods. While ACH payments are ideal for recurring transactions like payroll and utility payments, eChecks stand out for one-time payments, providing a faster and more streamlined process.

Choosing between ACH and eCheck depends largely on the specific needs of your business. Both offer unique advantages, from lower processing fees to faster transaction times. With companies like Vector Payments providing tailored solutions, transparent rates, and dedicated support, navigating the world of ACH and eCheck transactions has never been easier. It’s time to embrace the digital evolution of payments and unlock the potential of your business.

If you want to learn more about how to accept payments, feel free to contact us, today!

Frequently Asked Questions

What is an ACH payment?

An ACH payment is a system used in the US for electronic bank-to-bank transactions, allowing the transfer of money between accounts in the US. It is primarily used for processing electronic payments between banks.

What is an eCheck and how does it work?

An eCheck is an electronic version of a traditional paper check. It works by processing a digital version of a paper check to initiate a bank transfer through the ACH network.

How do ACH and eCheck transactions compare?

ACH and eCheck transactions both take 1-2 business days to clear, have low or no fees, and require customer authorization. ACH payments generally have lower processing fees and are preferred for recurring payments.

How can businesses overcome payment challenges?

To overcome payment challenges, businesses can partner with companies like Vector Payments to access tailored payment processing solutions, transparent rates, and dedicated support. This can help streamline and optimize their payment processes.

What are some best practices for secure and efficient payment processing?

To ensure secure and efficient payment processing, it’s best to implement fraud detection systems, establish customer authentication measures, verify eCheck transactions, reproduce authorizations, and set up an ACH payment system. These practices help to enhance security and streamline the payment process.